Léger Poll for CBC 2023 Annual Report

September 15, 2024

Back in April 2023, I posted that the Liberal government needed to make its case for defending or re-engineering the CBC.

Every month that went by with the Prime Minister ignoring the relentless Conservative messaging to “defund the CBC,” the more his detachment resembled Trudeau pater’s famous shrug.

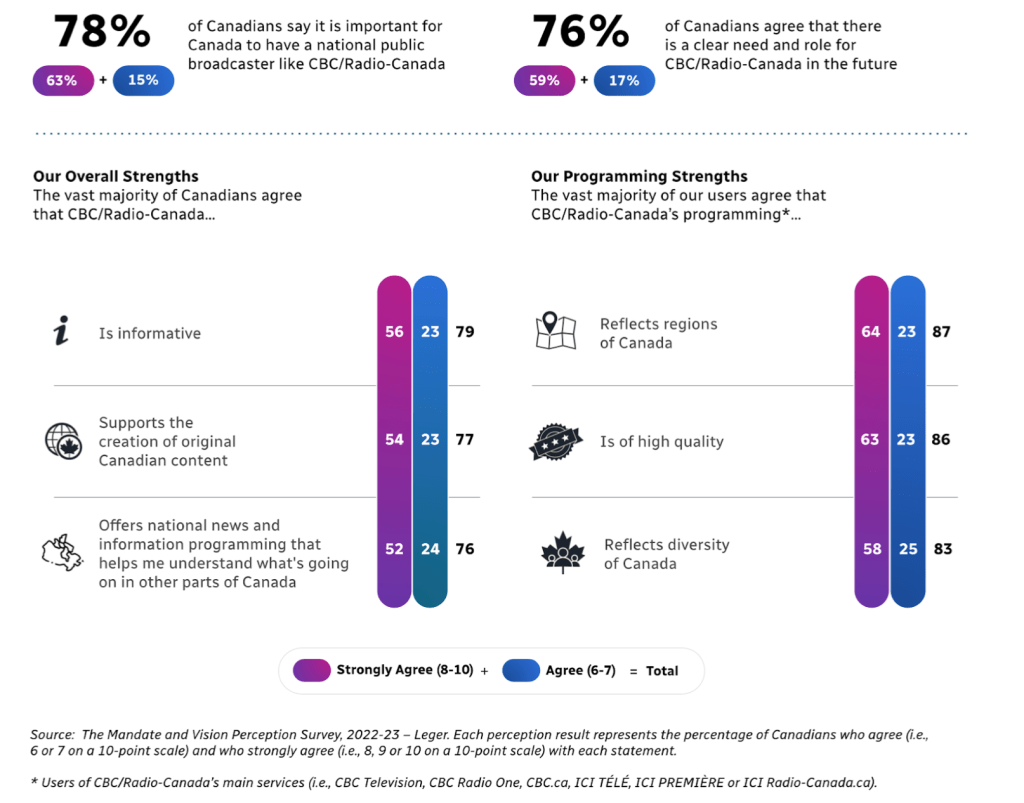

The CBC is no longer the political sacrament it once was (except in Québec) yet public opinion polling continues to reveal clear majority support for the public broadcaster, including one poll that showed a big appetite for improving it.

Heritage Minister Pascale St.-Onge got things going a year later in May 2024 when she appointed an expert committee to “advise regularly” on the CBC. So far, no reports.

This week the Minister posted a rather good pitch on social media posing intelligent questions about rethinking the CBC.

Why do we need a public broadcaster?

How do we keep CBC-Radio Canada independent, accountable, and serving the audience?

How does CBC stay relevant in the sea of Internet content?

How can CBC better reflect Canada?

All great questions, if obvious. What’s lacking are answers: the 81 second video ends with the message “Stay Tuned.” Let’s hope she’ll have something more to say about this before a Liberal election Red Book just repeats the good questions.

In the meantime, you can have your say through the Friends of Canadian Media survey portal.

Update: I recommend this recent commentary from Kirk Lapointe moving the yardsticks along on the public debate about rethinking the CBC.

***

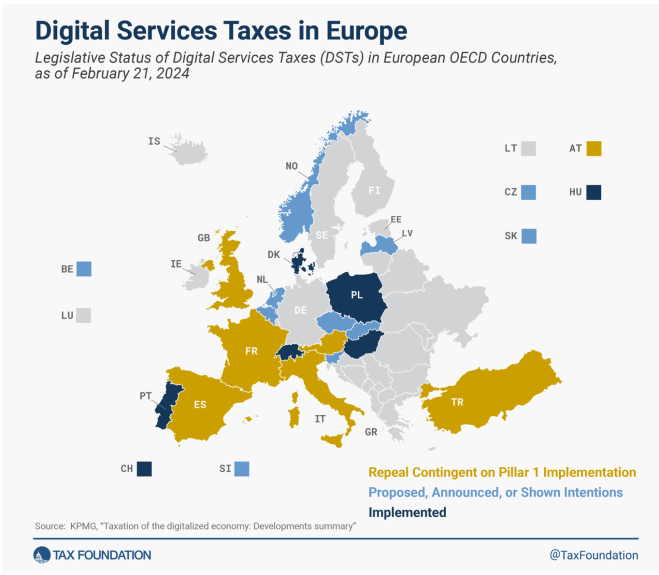

I wrote last week about the internecine friction between indie news publishers and mainstream news outlets in both Canada and California, scrapping over the spoils of settlements made with Google for its monetizing of linked news content on Search.

A spokesperson for the indie point of view —which is that mainstream digital publishers should not get their proportional share of any settlement —- was Ken Doctor, writing in Nieman Lab.

Doctor is the publisher of the Californian digital outlet, Lookout Santa Cruz, where his newsroom won the 2023 Pulitzer Prize for breaking news. The non-profit Lookout is not making money, but it’s stable, and Doctor is expanding his business model to another small community, this time up the coast in Eugene-Springfield, Oregon.

He was interviewed recently in Nieman Lab and gives away a few trade secrets there.

***

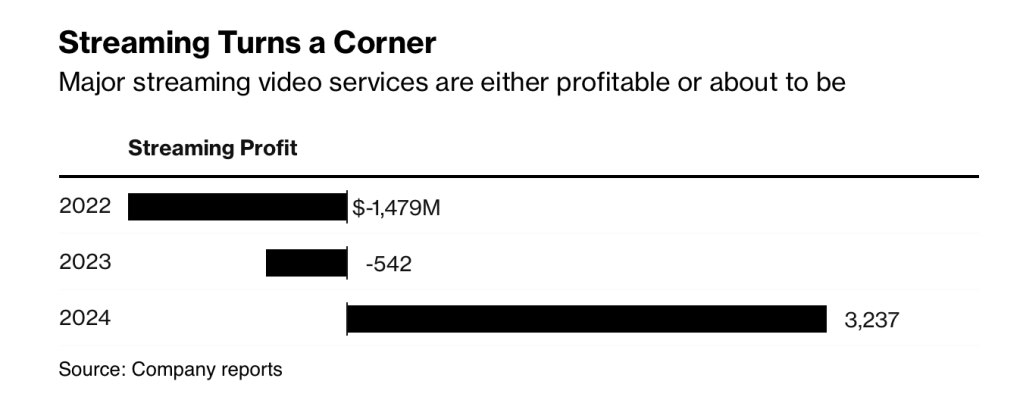

Last weekend I told you about my debate with Len St.Aubin. It began with his article in CARTT.ca touting the significance of Netflix’s investments in certified Canadian content over the last ten years and, as a consequence, his view that the CRTC should go easy on formal investment obligations for foreign streamers.

In his mid-week rebuttal, St.Aubin said that the increase in CanCon investment by foreign streamers is bigger than I gave them credit for, particularly after 2015.

Aside from the difficulty in measuring how much foreign investment in Canadian shows has grown since 2011, the real data problem we both struggle with is that we don’t know whether it was the Hollywood streamers or international broadcasters who fed it. As a former regulatory consultant to Netflix, St Aubin feels quite certain it’s the streamers. As a former Unifor spokesperson, I’m skeptical of the claim.

Regardless, that still leaves us evaluating St.Aubin’s contention that CRTC levies on the streamers will only eat up the streamers’ existing market-driven investments.

In an earlier article, St.Aubin suggested (reluctantly it seemed) no more than a 7.5% of revenue CanCon levy on streamers in the form of direct investments in Canadian dramas and documentaries (compared to the 29% benchmark for Canadian specialty broadcasters).

The two figures —7.5% versus 29%— don’t seem “equitable” between foreign and domestic broadcasters, required by the federal cabinet’s directive to the CRTC. But that argument is further down the regulatory road when the CRTC deals squarely with the issue.

I note that lately the CRTC chair Vicky Eateries has taken to describing the Commission’s future expectations of the foreign streamers’ CanCon spending as needing to be “meaningful.”

Parse, parse.

***

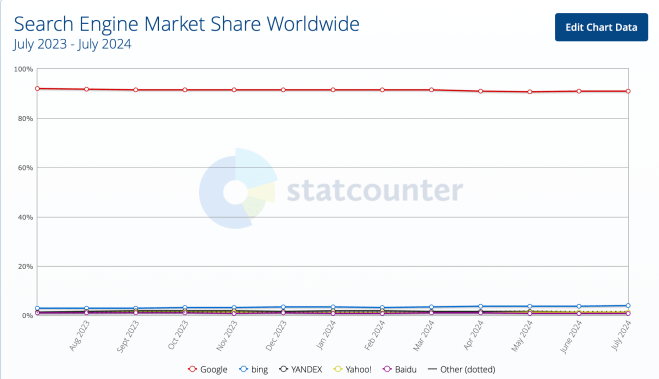

As you may recall, the US 3rd Circuit Court of Appeal recently ruled that Google is operating an illegal monopoly in Search.

Last week another anti-trust trial began for Google in the US. This time the Department of Justice is trying its case that Google has illegally cornered the Ad Tech market that feeds digital display advertising on websites.

Here’s some juicy court reporting from Reuters:

On the third day of the trial, prosecutors began to introduce evidence of how Google employees thought about the company’s products at the time when the government alleges it set out to dominate the ad tech market.

“We’ll be able to crush the other networks and that’s our goal,” David Rosenblatt, Google’s former president of display advertising, said of the company’s strategy in late 2008 or early 2009, according to notes shown in court...

Rosenblatt came to Google in 2008 when it acquired his former ad tech company, DoubleClick, and left the following year. The notes of his talk showed him discussing the advantages of owning technology on both sides and the middle of the market.

“We’re both Goldman and NYSE,” he said, according to the notes, referring to one of the world’s biggest stock exchanges at the time and one of its biggest market makers.

“We’ll do to display [advertising] what Google did to search,” Rosenblatt said.

By owning publisher ad servers, the advertiser ad network would have a “first look” at available spots for ads, he said according to the notes. He also said it was a “nightmare” for publishers to switch platforms.

“It takes an act of God to do it,” he said.

***

If you would like regular notifications of future posts from MediaPolicy.ca you can follow this site by signing up under the Follow button in the bottom right corner of the home page;

or e-mail howard.law@bell.net to be added to the weekly update;

or follow @howardalaw on X or Howard Law on LinkedIn.