December 19, 2021

Hey Google, Search this: France is vying with Australia for the title of feisty small sovereign nation (desolé) taking on Big Tech, having recently slapped Google with a $725 million fine for failing to negotiate seriously France’s implementation of the 2019 EU Copyright Directive for online platforms and publishers.

Google is still pushing hard around the globe to enforce its cut-rate version of pay-for-news-content. But the French government’s big fine has motivated the Tech giant to offer a negotiating process that includes the binding arbitration end-game legislated last February in Australia.

“American exceptionalism” means a lot of different things including staying at the back of the pack of jurisdictions pursuing Big Tech on pay-for-news-content and other monopoly abuses.

Google is trying to pre-empt Congressional action on pay-for-news-content by making offers to US publishers to sign up for the Google Showcase news portal while insisting on low rates of compensation. The offers have mostly been spurned by American publishers as “insulting” with a peppering of deprecating comments about the Showcase product itself. (A shout-out goes to Press Gazette US Editor William Turvill’s reporting.) However there is no sign of Congress backing up the publishers with Australian-style binding arbitration.

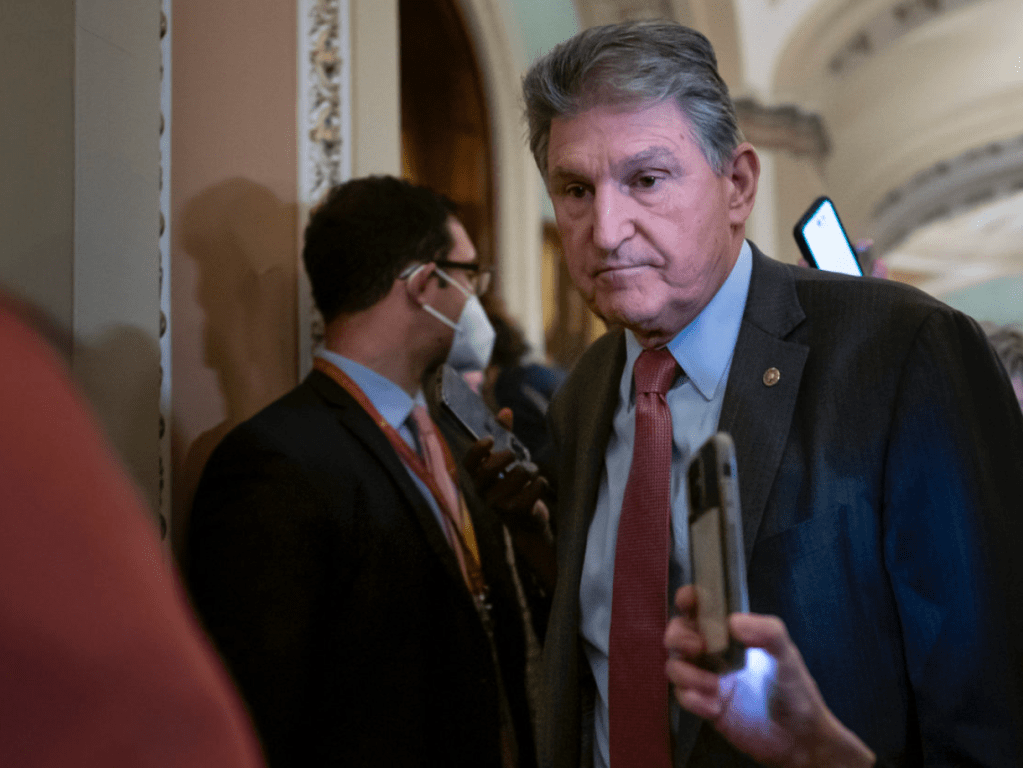

A fascinating step forward in US Congress is a federal salary subsidy for news journalism tagged on to President Biden’s US$1.75 Trillion Build Back Better legislation. BBB rests in the hands of the US Senate for now. The all important view of Democratic Senator Joe Manchin favours the journalism subsidy.

Also newsworthy in the US: the philanthropic journalism project Report for America is thriving and expanding next year to 325 internships in 270 newsrooms across all 50 states. One of many journalism foundations in the US, RFA is funded by the Knight Foundation, Walmart, Facebook, Google and others.

In case you are struggling to categorize the variety of funding projects around the world seeking to aid journalism, here are the major genres:

- Private negotiations between Google, Facebook and media outlets, largely a pre-emptive move by Big Tech: 15 countries including Canada, Australia, France, Germany, UK and the US.

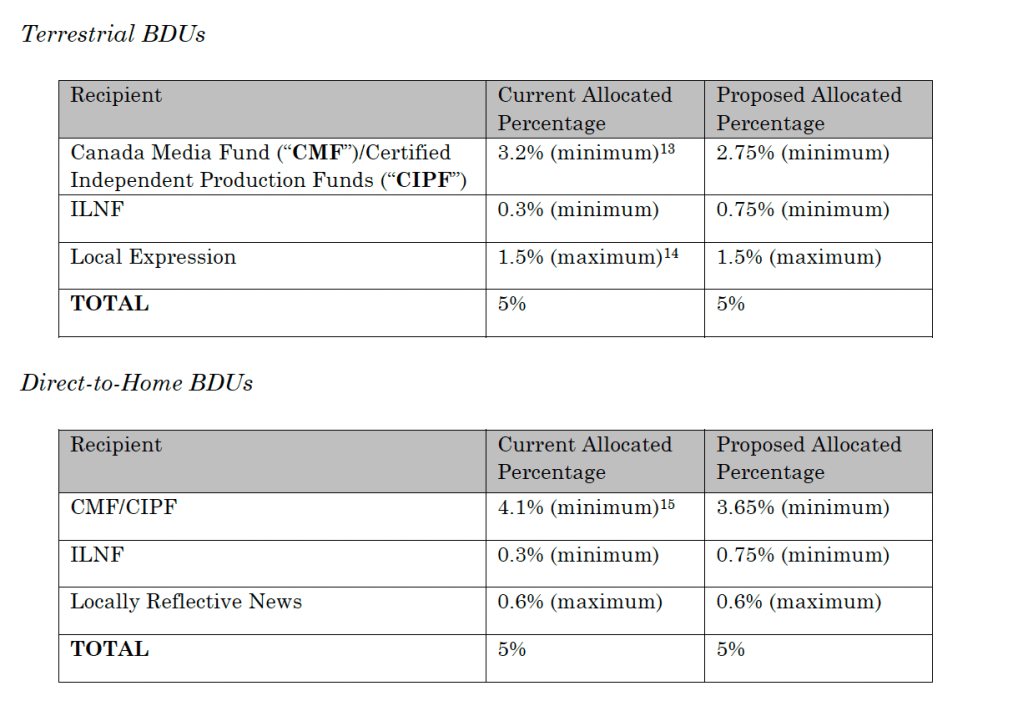

- Government backstopping to those private negotiations through legislated binding arbitration: Australia and the EU Directive as implemented in France. A Canadian Bill is on its way early in 2022.

- Direct government subsidies to news outlets, usually as a per journalist salary subsidy: several European countries for years, Canada, and perhaps the US if the BBB legislation gets through the Senate.

- Tax laws that incent philanthropic donations to journalism projects: widespread in the US which has a long history of favourable tax regimes and billionaire patronage. The Canadian federal government made this move in 2019 with little effect so far.

- Limited tax deductions for customer subscriptions: again legislated by Ottawa in 2019 but Canada Revenue Agency isn’t scheduled to report statistics until 2024.

An intriguing (and massive) public funding proposal to save news journalism is being touted by famed American cultural thinker Robert McChesney. I hope to devote a blog to his proposal soon.