Batter up: Mark Zuckerberg (Meta), Lauren Sanchez, Jeff Bezos (Amazon), Sundar Pichai (Google) and Elon Musk (X).

January 25, 2025

The memorable line-up of US tech bros attending Donald Trump’s inauguration as special guests is an early candidate for Photo of the Year, although it’s possibly been eclipsed by Elon Musk’s nazi salute of the same day.

What the Trump victory means for Canadian regulation of Internet services seems ominous and Michael Geist is first out of the gate with “I told you so.”

In the months ahead you’ll find a different perspective here on MediaPolicy, I promise.

Thanks to Trump, we are headed into a nation-defining crucible, as Jean Charest just argued persuasively on CBC News. Of course media policy is just one thing on the table and you can’t eat cultural sovereignty.

Forty years ago, a majority of Canadians voted against a free trade deal with the United States as an over commitment of our economic fortunes to a single dominant trading partner.

Despite quite a few rough spots with a trade partner that never plays by the rules, we muddled through until Trump the Sequel.

But if we stick together and get decent political leadership, we can come out the other side as a greater country and more independent of the United States.

Now is our time. Courage, my friends.

***

And now for something micro, not macro.

Dean Beeby just posted a Substack column reporting on per diems and expenses paid out by Revenue Canada to five veteran journalists serving on the Independent Advisory panel who give the thumbs up or down to media organizations applying for “QCJO” federal aid to online news journalism.

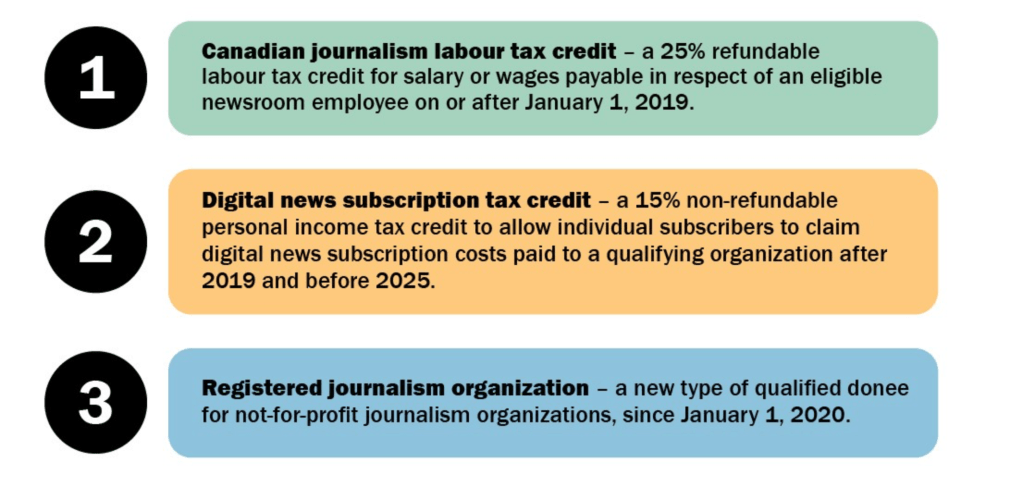

The Qualified Canadian Journalism Organization seal of approval unlocks reporter salary subsidies of 35% and reader tax credits of up to $75 per year in subscriptions paid.

The drift of Beeby’s article is that the news subsidies are bad —a debate for another day— and expensive to administer. Also, he says the costs of the entire program are not transparent because so little effort is made to publicize them.

The “$275 million” paid out in labour subsidies (spread out over six years, it’s worth mentioning) are reported in the government’s annual tax expenditure report.

The annual cost of the reporter subsidy was about $35 million until the government almost doubled its cost last year in response to the shortfall in anticipated news licensing payments from Google and Facebook. (The subsidy was boosted from 25% to 35% of a mid-range reporter salary of $85,000).

In addition to the $35 million labour subsidy, the reader tax credit has cost the public treasury about $15 million per year. With little fanfare, that subscription tax program expired on December 31, 2024.

The tax expenditure of a third QCJO program —-tax write-offs for private donations to non-profit journalism—- has never been released if it has even been tracked.

As for the Panel members’ compensation, Beeby notes that annual billings to the taxpayer have averaged $47,000. That’s divided among its five members. Most of their time is spent reviewing news articles submitted by QCJO applicants seeking to demonstrate “ongoing” (i.e. frequent) and “original” (i.e. not harvested from other sources) reporting of “news” (not opinion) that is of “general interest” (i.e. not niche or specialized).

I’m advised by panel Chair Colette Brin that its members bill the government on an hourly basis, with detailed timesheets, against the federal daily tariff of $275 to $450.

Since the program’s inception, the five panel members representing regions across the country have met online eighteen times rather than convene in Ottawa, except for a single in-person meeting costing $8000 in total travelling expenses.

Spitballing the three-part QCJO program cost at $90 million annually, the Panel’s administrative costs are 0.05% (half of a tenth of one per cent). The CRA did not provide Beeby with a costing of civil servants processing tax claims.

On the other hand, as Beeby points out, the lack of the government’s interest in pro-active transparency about the identity of the program recipients is baffling.

The Revenue Canada website does identify 191 news outlets whose readers are eligible for the now-expired QCJO reader tax credit (and therefore also the labour subsidy), but it does not reveal the unpaywalled news sites that only collect the labour subsidy. There may be as many as another 200 recipient news outlets basking in anonymity. As the reader tax credit has expired, it’s possible the list of 191 news outlets will disappear from public view.

The panel itself asked for more transparency as far back as 2019.

So have news organizations. Asked for comment, Paul Deegan of News Media Canada told MediaPolicy that “transparency is a necessary precondition for trust and accountability. We fully support making the list of QCJOs public, and we have asked the Government of Canada to do so.”

By comparison the $20 million per year Local Journalism Initiative, administered directly by Heritage Canada rather than Revenue Canada, requires recipient news organizations to identify the reporter subsidy on their mastheads.

In addition to identifying recipient news organizations so that readers can reach their own conclusions about accepting subsidies, there is the absence of employment and subscriber data that would permit public analysis of the programs’ effectiveness.

Did the $75 reader tax credit bring in new readers, or just subsidize the existing news junkies? Are labour-subsidized news organizations still laying off reporters or have numbers stabilized?

Transparency is the low hanging fruit in any public policy, especially a controversial one. It’s a harsh judgment on this federal government for not taking the simple steps here.

***

Here are two rabbit holes to dive down this weekend.

The first is an excellent backgrounder by Matt Stoller on the up-for-grabs US Congressional ban on TikTok, now delayed 90 days by President Trump. If you want a deeper (and Canadian) perspective, check out law professor Jon Penney’s guest column in the Globe and Mail.

The second is a Broadcast Dialogue podcast interview of Brodie Fenlon. The CBC Editor-in-Chief has many candid things to say, including some illuminating comments on the “niche casting” challenge for CBC News to meet younger audiences fragmented across the Internet, as well as TV viewers whose portal to content is the app menu embedded in foreign-made smart televisions.

***

If you would like regular notifications of future posts from MediaPolicy.ca you can follow this site by signing up under the Follow button in the bottom right corner of the home page;

or sign up for a free subscription to MediaPolicy.ca on Substack;

or follow @howardalaw on X or Howard Law on LinkedIn.

I can be reached by e-mail at howard.law@bell.net.

Howard, delightful. Is that beaver actually you ? I cannot help but be reminded of the famous WW1 recruitment poster : “What will your answer be when your boy asks you, “Father, what did you do to help when Britain fought for freedom in 1915? Enlist now”. I hereby sign up. Seriously, thank you for taking a stand. Tim

>

LikeLiked by 1 person